The Achilles Heel of the Digital Revolution: Cooling Systems?

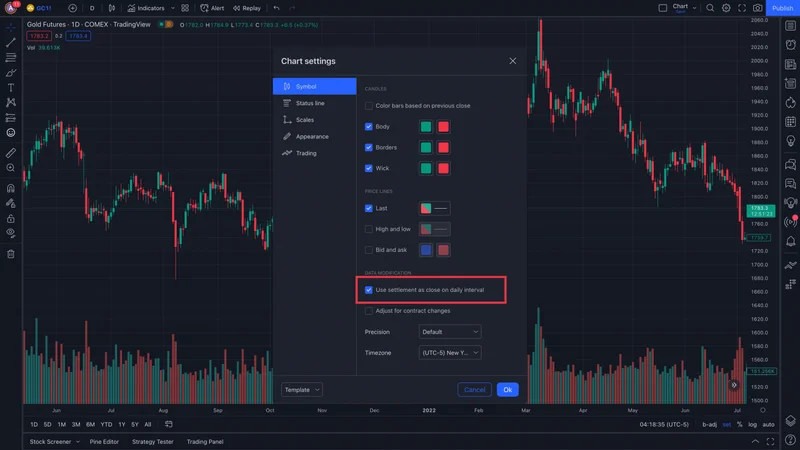

The Day the Markets Froze Okay, folks, let's talk about what happened on November 28, 2025. Now, I know what you're thinking: "Dr. Thorne, a trading halt? Cooling issues? Sounds like a plumbing problem, not a revolution!" But trust me, this little hiccup at the CME Group, where a cooling failure at a CyrusOne data center brought futures and options contracts to a screeching halt, is more significant than it appears. Especially when you consider the knock-on effect on Bitcoin and Ethereum futures. One trader called it a "nightmare," and honestly? I get it. Imagine this: you're in the middle of a crucial trade, the Asian markets are active, and suddenly... nothing. Just dead air. Crude oil, palm oil, crypto—all frozen in place. It’s like the financial world suddenly hit the pause button, all thanks to a broken AC. It sounds almost comical, right? But the implications are anything but. This wasn't just about a slow trading day exacerbated by the U.S. Thanksgiving holiday, as market analyst Tony Sycamore pointed out. This was a stark reminder that even in the age of decentralized finance and blockchain wizardry, we are still utterly reliant on the mundane, physical infrastructure that underpins it all. CyrusOne, with its 55+ data centers across the globe, is a silent giant, and when it stumbles, the whole world feels it. And here's where it gets really interesting. Bitcoin, which had been riding high with an 8.32% weekly gain, suddenly dipped 0.55% to $90,896. Was it *just* the cooling failure? Probably not. A massive $13.4 billion BTC options expiry squeeze was also in play, favoring bearish bets. But the halt certainly didn't help, did it? Bitcoin tested $91,800 resistance three times in 24 hours but couldn't hold. Was the outage a factor? We can't know for sure, but correlation often suggests causation. CME Group Halts Trading Due to Cooling System Failure - Cryptonews What does this all mean? Well, it throws a spotlight on a critical, often overlooked aspect of the crypto revolution: infrastructure resilience. We're so busy dreaming about decentralized ledgers and smart contracts that we sometimes forget the whole thing relies on servers staying cool. Think of it like this: we're building a magnificent digital skyscraper, but the foundation is still made of concrete and steel, vulnerable to the elements.Beyond Code: Decentralizing the Entire System

The Bigger Picture: Decentralization Beyond Code The crypto world prides itself on decentralization, on escaping the clutches of centralized authorities. But what good is a decentralized currency if its trading infrastructure is vulnerable to a single point of failure? This cooling issue wasn't just a technical glitch; it was a wake-up call. We need to think about decentralizing *everything*, not just the code. We need redundant systems, diverse geographical locations, and robust backup plans. I keep thinking about that user on X, asking CME Group to cancel losses for any stuck trades. It’s a natural reaction, born of frustration and a sense of injustice. But it also highlights the inherent risks in a system still finding its footing. How do we build a truly resilient financial ecosystem that can withstand not just market volatility, but also… well, a hot server room? This is the kind of challenge that gets me genuinely excited. It's not just about writing better code; it's about rethinking the entire infrastructure from the ground up. Can we use renewable energy sources to power these data centers, making them more sustainable and less vulnerable to grid failures? Can we develop new cooling technologies that are more efficient and less prone to breakdowns? Can we distribute the computing load across multiple smaller, independent data centers, creating a truly decentralized network? The possibilities are endless, and honestly, it reminds me why I got into this field in the first place. I want to see a future where our financial systems are not just technologically advanced, but also robust, resilient, and accessible to everyone. A Catalyst for a Stronger Future So, was this CME cooling failure a blip or a bellwether? I think it was a bit of both. It was a temporary setback, yes, but it was also a crucial learning opportunity. It forced us to confront a weakness in our armor, a vulnerability that we can now address and overcome. It's a reminder that even the most revolutionary technologies need a solid foundation to stand on. And it's an invitation to build that foundation stronger, more resilient, and more decentralized than ever before. This isn’t just about crypto; it's about the future of all digital infrastructure.